#Irs printable form for 2016 extension form plus

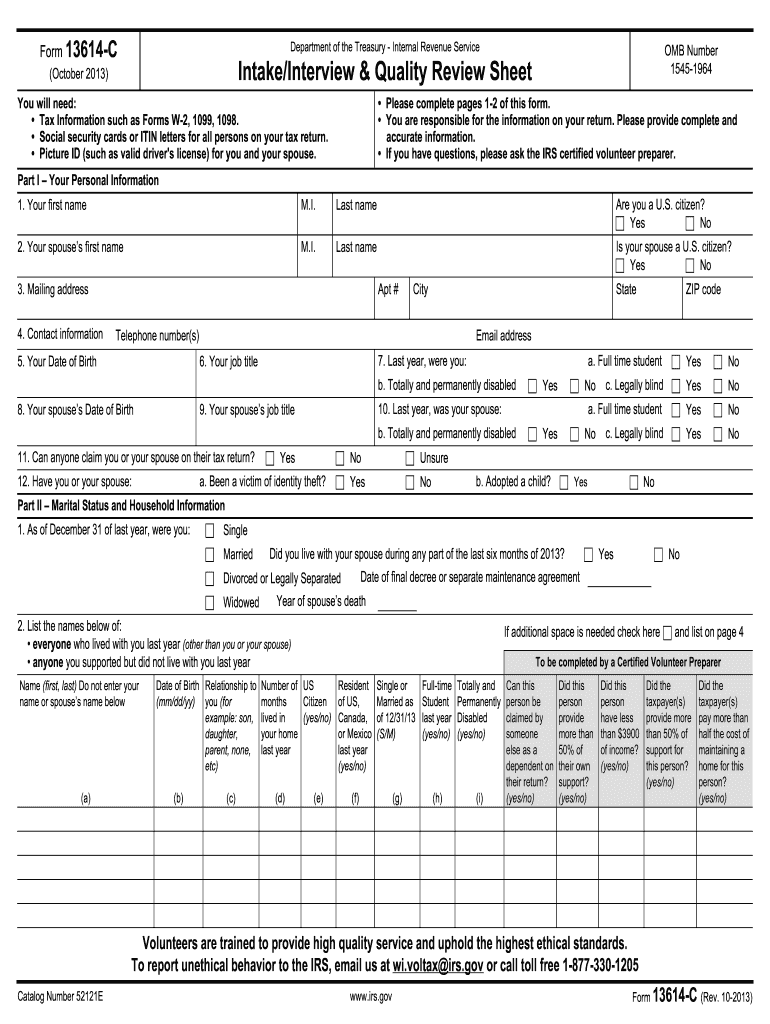

Birth dates for yourself (along with your partner, plus any dependents).Social Security Numbers for yourself (and also your partner and any dependents).When Getting Ready to Fill out Your Tax FormsĮven before you start doing your 1040 tax forms, you need to have the following material ready: It is possible to ask for a tax extension by sending in IRS Tax Form 4868 by the initial submitting due date (April 15). You are usually subject to fines and/or overdue charges if you do not submit by this date. The 1040 Form is usually due by April 15, except if you request an automatic tax extension. Although the 1040 usually takes more time to fill out, it rewards taxpayers by offering them extra possibilities to reduce their income tax bills. It is usually referred to as “the long-form” since it is more in-depth than the shorter 1040A and 1040EZ income tax forms.Īlso, in contrast to the various other tax forms, IRS form 1040 permits taxpayers to claim several expenditures and tax incentives, list deductions, and modify income. Income Tax Return for Certain Nonresident Aliens Who Have No Dependents)įorm 1040 is the usual federal income tax form widely used to record an individual’s gross earnings (e.g., income, products, real estate, and services). Form 1040EZ (Income Tax Return for Unmarried and Combined Filers Who Have No Dependents).The Short Form or Form 1040A (Individual Income Tax Return in the U.S.).The Long Form or Form 1040 (Individual Income Tax Return in the U.S.).IRS Tax Form 1040 (Individual Income Tax Return in the U.S.).The Previous 1040 Forms and Instructions:Īre you aware that there are a few different kinds of IRS form 1040 and instructions? It’s best to know which income tax form suits your specific circumstance and lets you declare the earnings, deductions, credits, etc., that relate to you. Tax forms are supplied automatically when you file your taxes onlineĪlso, almost all post offices and neighborhood libraries have tax forms and instructions available throughout tax season, and forms are also available from a tax center or an IRS office.Īdditionally, you could ask for a tax form to be delivered to you from the IRS by U.S. Printable tax forms can be downloaded from our IRS tax forms page.Ģ. Here are two good methods to get tax form 1040 & instructions.ġ. Where to Get the New IRS 1040 Tax Forms & Instructions When you file with the new 1040 form, you won’t have to worry about new forms, schedules, or instructions because they will be supplied automatically and filled out for you. However, if you plan to itemize, you will need to file additional schedules with your 1040. If you plan to claim the standard deduction, the new 1040 is all you will need to file. The new changes do away with the original 1040ez and 1040a form and adds new supporting schedules. The new form will consolidate the former three forms into a simpler, shorter version of the original. The IRS has been working on a newly designed version of the Tax Form 1040.

#Irs printable form for 2016 extension form how to

8 How to File Taxes Online in 3 Simple Steps - TurboTax Tax Tip Video.6 Get Your Refund Faster by Filing Online.5 When Getting Ready to Fill out Your Tax Forms.4 IRS Form 1040 is Known as the Long Form.3 The Previous 1040 Forms and Instructions:.2 Where to Get the New IRS 1040 Tax Forms & Instructions.Where to Find IRS Form 1040 and Instructions.What is the Dependent Tax Credit, Deduction and Exemption?.Tax Deductions Families Can Claim for Dependents.How to Claim a Medical Expense Tax Deduction.What is the Tax Credit for Electric Cars?.Energy Tax Credits for Home Improvements.

0 kommentar(er)

0 kommentar(er)